Figure: Stellar Logo

In a world that is more connected than ever, making payments across borders still has its limitations: one often has to work with multiple banks and intermediaries to transfer money internationally. This is where Stellar steps in. Through Stellar, the Stellar Development Foundation (SDF) aims to connect the different financial systems worldwide. Stellar is an open-source and decentralised platform where people can store and transfer money using any currency they like. Stellar opens up the markets and gives people more control over their money.

Context

People use money as a medium of exchange, as a store of value, and as a unit of account. In other words: money allows for value-based trading by acting as an intermediary, alleviating the need for bartering, allows us to retain and exchange value over time, and allows us to easily compare values of widely differing goods and services. People primarily store money in the physical form, or digitally at centralised entities, such as banks.

When people want to make cross-border transactions, they often have to use multiple centralised entities, such as currency exchanges and international banks. Financial services provided by currency exchanges and international banks often come at a cost that might limit the potential of poor individuals or communities.

Blockchain technology can provide a way in which people can execute global money transfers and storage without the interference of a centralised entity, just like the exchange of physical cash. By not relying on a centralised entity, the single point of failure that banks currently constitute is removed from the monetary system.

To be able to provide an alternative to fiat currencies for mid- to long-term retainment of converted asset value, the currency should be stable. To this end, Stellar should be able to support easy conversion of different assets, so that it becomes possible to hold stable currencies as your savings, whilst easy payment is possible in the local currency through fast conversion at any moment.

The exchange should have low fees, be as close to instantaneous as possible, and have a low barrier to entry, to be a viable alternative to centralised banks.

The world of cryptocurrencies

Since the creation of bitcoin in 2009, the demand for cryptocurrencies has grown steadily. With over 4000 different currencies in circulation and a combined market capitalisation that has seen a sevenfold increase in the last year to a total of 1.4 trillion dollars, the cryptocurrency world is growing steadily. Cryptocurrency enthusiasts call for cryptocurrencies to replace ‘regular’ fiat currencies, and large companies are starting to store large parts of their money in cryptocurrencies.

Some cryptocurrency organizations, including Stellar, are trying to reduce the gap between fiat currency and cryptocurrency by creating a bridge between fiat and crypto using on-off ramps. More on on-off ramps can be found in the next topic. Whether you will soon be able to pay with cryptocurrency at your local bakery is something only time can tell.

Use cases for Stellar

Using Stellar, you can theoretically convert any asset you own onto the blockchain, to be traded globally and almost instantaneous. This process is called ‘tokenisation’, and people who tokenise an asset are called ‘Anchors’. Anyone can become an Anchor, as long as they provide three functionalities:

- Provide what is called an on/off-ramp. This means providing a way for users to deposit and withdraw their assets as seamlessly as possible (similar to how a bank allows you to deposit and withdraw cash to and from your digital bank account).

- Issuing the token: this means that for any token on the network, the Anchor provides a one-to-one reserve equivalent to the value of the issued token so that users can redeem their tokens back to the asset at any time.

- Handling regulatory processes, such as the Know Your Customer (KYC) regulation in the United States. 1 2 3

Examples of tokenised assets are USD, EURT, and GOLD, which tokenise the US Dollar, the Euro, and gold respectively.

Currently, there are 9,463 different assets on the network. A full list of the assets can be found on Stellar.expert 4.

Having a wallet on a Stellar network means you can store any tokenised asset in a digital wallet, which can be accessed at any time. Lumens (or XLM) are a token on the Stellar network created by the SDF. They are the currency in which transaction fees on the network are paid 5

Transferring a token from your wallet to someone else’s is a very easy process for most wallets.

Each transaction requires a sender and receiver address and can be accompanied by a memo (text).

After sending the transaction, some security steps take place as described in the Stellar Consensus Protocol, and when the transaction is verified by the protocol the changes propagate throughout the network.

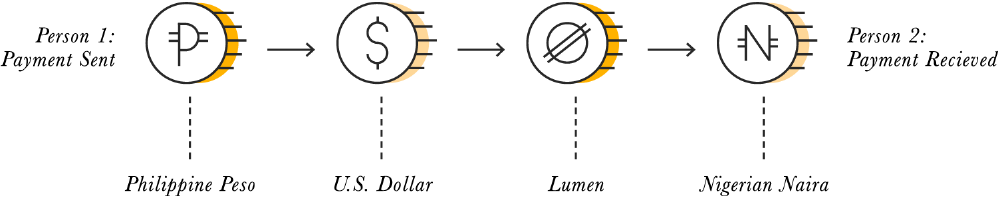

For exchanging different tokens, Stellar has a built-in decentralised exchange. It also comes with cross-asset payment support. This means that Stellar can automatically convert your tokens into any other token on the network, at the best available rate. Even if no-one is currently exchanging GOLD tokens for EURT tokens, Stellar can come up with a path from GOLD to USD to EURT (or any other shortest path that is most efficient) so that you can pay with any currency on the network at any time.

This process is called pathfinding. 6

Figure: Cross-asset payment through the Stellar network

To support the Stellar network, nodes are required to execute and verify transactions. There are no monetary incentives for nodes. The main incentive is thus to secure the reliability of the network. Transactions are verified by nodes using the Stellar Consensus Protocol, which is based on Federated Byzantine Agreement. In short, the Federated Byzantine Agreement protocol distinguishes itself by its requirement of a quorum rather than unilateral agreement. This makes that it is a faster and more efficient protocol. Compared to other blockchain verification protocols, this protocol is much faster and more efficient. We encourage you to read more about the protocol on https://developers.stellar.org/docs/glossary/scp/ as it is one of Stellar’s main unique selling points. 7

Figure: The Federated Byzantine Agreement process (source: https://medium.com/interstellar/understanding-the-stellar-consensus-protocol-423409aad32e)

Transactions and exchanges incur fees to limit the amount of spam on the network.

Fees are paid in XLM and start at 0.00001 XML per operation depending on the capacity of the network and the current activity.

The paid fees are stored in a separate fee pool, a locked and unused account in the hands of the SDF. 8

Key qualities

Stellar differentiates itself from conventional transaction systems by its high reliability and transaction properties. It differs from other cryptocurrencies by its unique tokenisation system and the ability to more easily comply with regulations imposed upon it.

Safety and Reliability

Stellar leverages blockchain technology to ensure safety and reliability. Since Stellar depends on a wide and distributed network of validators all around the globe, the system can easily take care of local problems such as power outages.

On top of that, because all nodes operate on the network independently, the system cannot easily be breached by hacks targeted at critical infrastructure: the attacker would have to target a large number of validators all around the globe.

Conventional transaction systems which do not utilise this technology and rely on more centralised infrastructure, are prone to hacks targeted at critical parts of the system. For example, servers that operate the SWIFT network or digital infrastructure of banks could be targeted.

These conventional systems faced numerous outages and downtime in the past: the SWIFT system had a downtime of 6358.20 minutes in 2020 alone. This does not even include local problems that banks themselves have. Stellar’s last outage was almost two years ago, further supporting the claim of the high reliability of the Stellar network. 9

Transaction speed and volume

For conventional systems, it can take days before a transaction is processed, mainly because many parties can be involved in a single transaction. Many governments and banks try to develop national payment systems to process payments efficiently, a good working example is the Dutch payment system called iDeal. The system has an uptime of 99.88% and a cost of 19 cents for every transaction and a transaction time of seconds. Banks in the Eurozone can use the SEPA protocol to instantly perform transactions. However, these systems only work nationally or between a few countries: banks still have to use the SWIFT system internationally, and this system takes at least a day to process a transaction. Stellar processes transactions with an average speed of 5.5 seconds, independent of location, outpacing most national and all international protocols. 10 11 12

Transaction costs

In developed countries, almost all citizens have a bank account to transfer and receive financial assets. Yet, in 2017, 31 per cent of all adults did not have a bank account and were therefore not able to make bank transfers. Bank transfers are relatively cheap: ING charges 6 euros for international transactions, where a specialised company like PayPal charges 5% for an international transfer. One should note, however, that most people need to pay for a banking subscription on top of the transaction fees. The average transaction fee per transaction on the Stellar network is currently 0.000004 dollar when the network is not heavily congested. To send and receive assets, one has to stay above a balance of 1 lumen, which is currently equivalent to roughly 0.40 US Dollars. When the network is heavily congested, the transaction fee can slowly increase. The system does not diversify transaction costs based on location or distance between users. 13 14

Adoption

Stellar relies on blockchain technology. Thus, a big network of validators is needed to ensure the security and reliability of the project. On top of that, to facilitate transactions between two parties, both parties should have a Stellar wallet and confidence in the system. Therefore the adoption by consumers is a crucial asset for the Stellar system.

Conventional currencies, which can suffer from hyperinflation, or cryptocurrencies, which are highly volatile, are inconvenient to use in ordinary transactions. Stellar uses tokenisation to solve this problem.

This allows users to replicate a real-world monetary asset on the Stellar system, enabling the users to use their native currency or any other currency. This makes it easier to accept as a form of payment, as it has the same value as the native currency.

In the early days of cryptocurrencies, regulation was one of the main concerns. The illegal marketplace Silk Road used Bitcoin for its transactions, which deteriorated the reputation of cryptocurrencies as payment options. The implementation of Stellar allows international and local regulators to enforce financial policies on the network. Anchors can connect the Stellar Network to their country’s banking system and regulatory processes, it is one of the few cryptocurrency networks that comply with local laws. 15

Stellar’s Stakeholders

Stellar is maintained by the Stellar Development Foundation (SDF). This foundation is a non-profit that oversees the development and promotion of Stellar. The SDF has 30 billion Lumens which it will use to invest in Stellar. This is also where the pay for the 80 Stellar developers of the SDF largely comes from. Before the value of the Lumen was high enough to provide for the developers, financial service provider Stripe invested 3 million dollars in 2014 in the SDF. In return, they received 2 billion Lumens.

Stellar is an open-source platform to which everybody can contribute, and over 90 people have done so. This contribution goes through Stellar’s repository on the major open-source collaboration platform GitHub. 16

Stellar has over 11 million accounts and already processed over 3 billion transactions. Consumers are the end users that buy and transfer both Lumens and other tokenised assets on the platform.

Stellar can offer many different assets through the earlier mentioned Anchors. They form the bridge between traditional market systems and Stellar. To prevent fraud and money laundering KYC (Know Your Customer) and AML (Anti Money Laundering) checks need to be performed by Anchors. Since Stellar allows the transfer of money across borders and each local financial system has specific requirements, the regulators oversee whether they adhere to local monetary laws.

Roadmap

The main objective of Stellar in 2021 is growth. Not just growth in the number of users and transactions but also in the number of people that know of Stellar. This objective is supported by three strategic pillars

- Support the robustness and usability of Stellar

- Help Stellar be the blockchain people know and trust

- Foster and develop sustainable Stellar use cases for cross-border payments and securitised assets.

The first pillar aims to make sure the platform can handle growth. The focus points are to increase safety, to strengthen Stellar’s underlying systems, and to improve liquidity. These measures should help Stellar attract not only more users but also show to others that Stellar is reliable and can add value.

The second pillar aims to spread awareness and grow the ecosystem of Stellar. This is partially to grow the number of users and transactions. The other part is to bring Stellar into more conversations with key stakeholders, such as regulators and developers.

The last pillar is to expand the functionality of Stellar by supporting companies that build on Stellar and to show what Stellar can become.17

Ethical considerations

The ethical foundation of the Stellar network is quite strong, as it aims to allow for low-cost financial transfers in emerging economies. Further ethical strong points are the open-sourcing of the Stellar codebase and their non-profit Stellar Development Foundation which supports the development and growth of Stellar.

A consideration related to the market mechanisms in the Stellar network is the surge pricing mode. When the network’s capacity is exceeded, the transaction fees are automatically increased. This causes the availability of transaction processing to the ledger to only be available to the highest bidders first, which will disproportionally hit people that have limited funds available for transactions.

As can be seen Stellar has a delicate position due to its focus on emerging markets. However, we believe, that with Stellar’s approach of being the bridge between fiat and crypto, complying with regulators, and being non-profit, these risks are mitigated as much as possible, and do not outweigh the potential gains of achieving Stellar’s mission: providing the world with secure, fast, cross-border payments.

References

-

Anchor basics, Retrieved 8 Mar, 2021, from https://www.stellar.org/learn/anchor-basics ↩︎

-

Anchor implementation, Retrieved 8 Mar, 2021, from https://github.com/stellar/stellar-protocol/blob/master/ecosystem/sep-0024.md#basic-anchor-implementation ↩︎

-

Anchor development, Retrieved 8 Mar, 2021, from https://www.stellar.org/developers/guides/anchor/index.html ↩︎

-

Stellar Expert asset overview, Retrieved 8 Mar, 2021, from https://stellar.expert/explorer/public/asset ↩︎

-

Stellar Lumens, Retrieved 8 Mar, 2021, from https://www.stellar.org/lumens ↩︎

-

Decentralized Exchange, Retrieved 8 Mar, 2021, from https://developers.stellar.org/docs/glossary/decentralized-exchange/ ↩︎

-

Stellar Paper, Retrieved 8 Mar, 2021, from https://www.stellar.org/papers/fast-and-secure-global-payments-with-stellar ↩︎

-

Fees, Retrieved 8 Mar, 2021, from https://developers.stellar.org/docs/glossary/fees/ ↩︎

-

Stellar Availability, Retrieved 8 Mar, 2021, from https://www.swift.com/myswift/availability-statistics ↩︎

-

iDeal, Retrieved 8 Mar, 2021, from https://www.ideal.nl/actueel/kerncijfers/ideal-beschikbaarheid/ ↩︎

-

Processing Times, Retrieved 8 Mar, 2021, from https://www.abnamro.nl/en/personal/payments/making-payments/processing-times.html ↩︎

-

Network Activity, Retrieved 8 Mar, 2021, from https://stellar.expert/explorer/public/network-activity ↩︎

-

Global Index Retrieved 8 Mar, 2021, from https://globalfindex.worldbank.org/basic-page-overview ↩︎

-

PayPal, Retrieved 8 Mar, 2021, from https://www.paypal.com/us/webapps/mpp/paypal-fees ↩︎

-

Trautman, L. J. (2014). Virtual currencies; Bitcoin & what now after Liberty Reserve, Silk Road, and Mt. Gox?. Richmond Journal of Law and Technology, 20(4), https://scholarship.richmond.edu/cgi/viewcontent.cgi?article=1400&context=jolt ↩︎

-

GitHub repositories for Stellar, Retrieved 8 Mar, 2021, from https://github.com/stellar/ ↩︎

-

Stellar Roadmap, Retrieved 8 Mar, 2021, from https://www.stellar.org/roadmap ↩︎